Introduction

In the ever-evolving world of cryptocurrency, understanding the

Analyzing Market Behavior

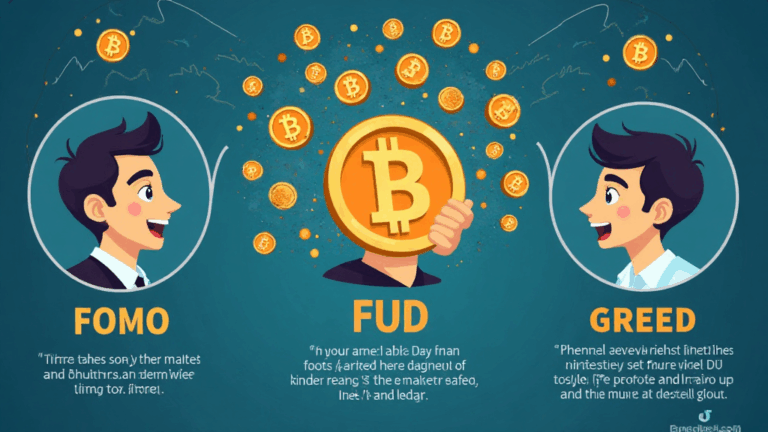

At the core of every market movement is a collective human sentiment. The psychology of the crypto market can be broken down into several key emotional drivers:

ong>Fear of Missing Out (FOMO): ong> Many investors feel a pressure to jump into the market as prices soar, often leading to irrational decisions.ong>Fear, Uncertainty, and Doubt (FUD): ong> Negative news, whether real or fabricated, can trigger widespread panic sells.ong>Greed: ong> As prices rise, the desire for quick profits can lead to riskier investments.ong>Hope: ong> Conversely, during downturns, the desire to hold on in the hope of a market recovery can keep investors entrenched in losing positions.

The Role of Social Media

Social media platforms play a significant role in shaping crypto market psychology. Tweets or posts from influential figures can cause significant market fluctuations. For instance, a single tweet from a Bitcoin enthusiast can lead to a surge in buying pressure, triggering FOMO among other investors. It’s essential for traders to recognize these patterns and understand how sentiment can swing the market.

The Vietnamese Crypto Market: A Case Study

Vietnam has seen unprecedented growth in cryptocurrency adoption, with a reported

- Many Vietnamese investors are heavily influenced by social media trends, leading to rapid buying and selling.

- Educational resources in Vietnamese (e.g.,

ong>tiêu chuẩn an ninh blockchain ong>) are on the rise, helping to mitigate FOMO.

Strategies for Navigating Crypto Market Psychology

To effectively navigate the emotional landscape of crypto investments, consider the following strategies:

ong>Educate Yourself: ong> Understanding cryptocurrency technologies and market trends can provide confidence and reduce impulsive decision-making.ong>Establish Clear Goals: ong> Have a clear investment strategy, defining profit targets and acceptable losses to minimize emotional trading.ong>Follow the News, Not the Hype: ong> Stay informed about market developments, but avoid getting swayed by sensational news articles.ong>Utilize Trading Tools: ong> Tools like automated trading can help mitigate emotional responses during volatile market conditions.

Long-Term Investment vs. Short-Term Trading

The choice between long-term investment and short-term trading reflects different psychological approaches:

ong>Long-Term Investment: ong> This approach often leads to more rational decisions as investors overlook short-term fluctuations.ong>Short-Term Trading: ong> This can be more emotionally taxing as traders respond to market movements almost instantaneously.

Ultimately, understanding your own emotional triggers as a trader is key to developing a successful strategy in the

Conclusion

As the crypto market continues to develop, understanding investor psychology will become increasingly critical. By recognizing the emotional currents that drive market fluctuations, traders can enhance decision-making and invest more wisely, thus reducing risks associated with impulsive trading based on short-term market psychology. For those navigating the myriad challenges of the crypto landscape, leveraging tools and insights into

In conclusion, if you’re serious about investing in cryptocurrency, it’s crucial to align your strategies with both the technical aspects of the market and the psychological factors influencing price movements. As always, remember that this article is not financial advice; consult local regulators and make informed decisions. For more insights on cryptocurrency and market psychology, check out ristomejidebitcoin.

Expert Author

Jane Doe is a renowned blockchain analyst who has authored over 15 papers in the field and led multiple high-profile project audits in the crypto industry.