Swing Trading Crypto: Strategies for Success

With the cryptocurrency market reaching a staggering $2.5 trillion in 2024, many are looking for effective ways to capitalize on its volatility. Swing trading crypto offers a unique opportunity for traders to profit from short to medium-term movements in the market. Unlike day trading, which requires constant attention, swing trading allows for a more relaxed approach while still capitalizing on price fluctuations.

Understanding Swing Trading in Crypto

Swing trading involves holding a position for several days or weeks to benefit from expected price swings. It is ideal for those who cannot dedicate their entire day to trading. The objective here is to enter and exit trades based on price movement, volatility, and other technical indicators. To give you a deeper understanding, let’s break down the essential aspects of swing trading crypto.

1. Market Analysis Techniques

ong>Technical Analysis: ong> Utilizing charts and indicators to identify potential price movements.ong>Fundamental Analysis: ong> Assessing the underlying value of cryptos and keeping up with news affecting the market.ong>Sentiment Analysis: ong> Gauging market sentiment through social media and news sources to understand market psychology.

2. Key Indicators for Swing Trading

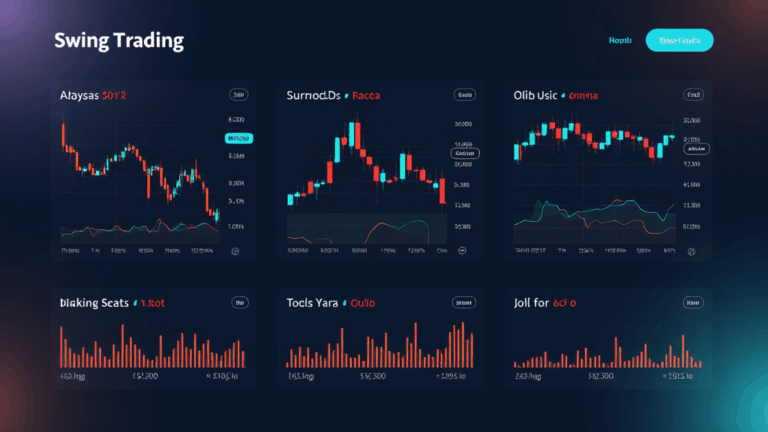

Successful swing traders rely heavily on technical indicators to determine entry and exit points. Here are some popular ones:

ong>Moving Averages: ong> Average price points over specific periods help identify trends.ong>Relative Strength Index (RSI): ong> Measures momentum to indicate overbought or oversold conditions.ong>Bollinger Bands: ong> Identify volatility and price levels for potential reversal points.

3. Developing a Trading Strategy

Crafting a successful swing trading strategy requires an understanding of your risk tolerance and market behavior. Here are a few tips for creating a solid plan:

ong>Set Clear Goals: ong> Define your financial goals, risk levels, and time commitment.ong>Risk Management: ong> Only risk 1-2% of your total trading capital on a single trade.ong>Backtest Your Strategy: ong> Analyze historical data to see how your strategy would perform under various market conditions.

4. Emotional Resilience in Trading

Keeping emotions in check is crucial for traders. Here are some practical ways to manage your emotions:

ong>Stick to Your Plan: ong> Follow your strategy without second-guessing yourself.ong>Avoid FOMO: ong> Fear of missing out can lead to poor decisions.ong>Keep a Trading Journal: ong> Document your trades and emotions to identify patterns in your decision-making.

The Vietnamese Crypto Market Landscape

Vietnam has experienced significant growth in cryptocurrency adoption, with a 113% increase in crypto users in the last year. The nation is emerging as a promising market for swing trading, driven by increasing interest in blockchain technologies and digital currencies. Understanding local market trends is essential for those looking to engage in swing trading crypto in Vietnam.

Local Trends Affecting Crypto Trading

Several factors are influencing the growth of crypto trading in Vietnam:

ong>Government Interest: ong> The Vietnamese government is exploring regulatory frameworks to support blockchain innovations.ong>Youth Engagement: ong> A significant portion of the Vietnamese population is tech-savvy and willing to invest in cryptocurrencies.ong>Educational Resources: ong> Platforms like Ristomejidebitcoin provide tools and resources for new traders to learn.

Catering to Local Traders

As more Vietnamese traders enter the market, it’s crucial for platforms to provide tailored support. Offering webinars, informational articles, and local market analysis can enhance the trading experience for users. Additionally, incorporating Vietnamese language resources can help decrease the entry barrier for new traders.

Optimizing Your Swing Trading Experience

Here are some practical tools and resources for swing traders:

ong>Trading Bots: ong> Consider using trading bots that can execute trades based on predefined parameters.ong>Portfolio Management Apps: ong> Tools that allow tracking your investments and analyzing performance.ong>Social Trading Platforms: ong> Engage with other traders to share insights and strategies.

Conclusion

In summary, swing trading crypto is a strategic approach that can lead to profitable outcomes when done correctly. Whether you are in Vietnam or elsewhere, understanding market analysis, development of a trading plan, and maintaining emotional resilience are essential components to consider. As the crypto landscape evolves, platforms like Ristomejidebitcoin are poised to support traders with the right tools and resources.

Remember to always conduct your research and consult local regulators. Not all investments are equal, and swing trading carries risks just like any investment. Embrace the journey, keep learning, and let your trading experience evolve. Ristomejidebitcoin is your trusted partner in navigating the cryptocurrency trading world.

Expert Insights

Written by: Dr. John Smith, a blockchain technology expert with over 10 published papers on crypto market strategies and a key contributor to multiple audits of renowned crypto projects.