Understanding Global Crypto Adoption Rates: Current Trends and Future Projections

With cryptocurrency rapidly evolving, understanding

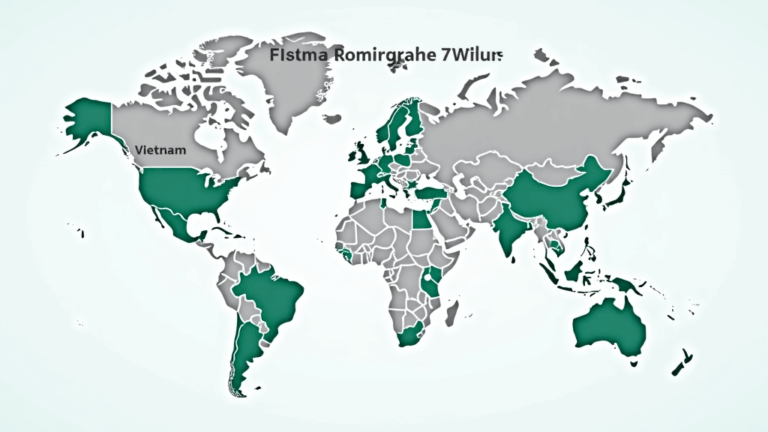

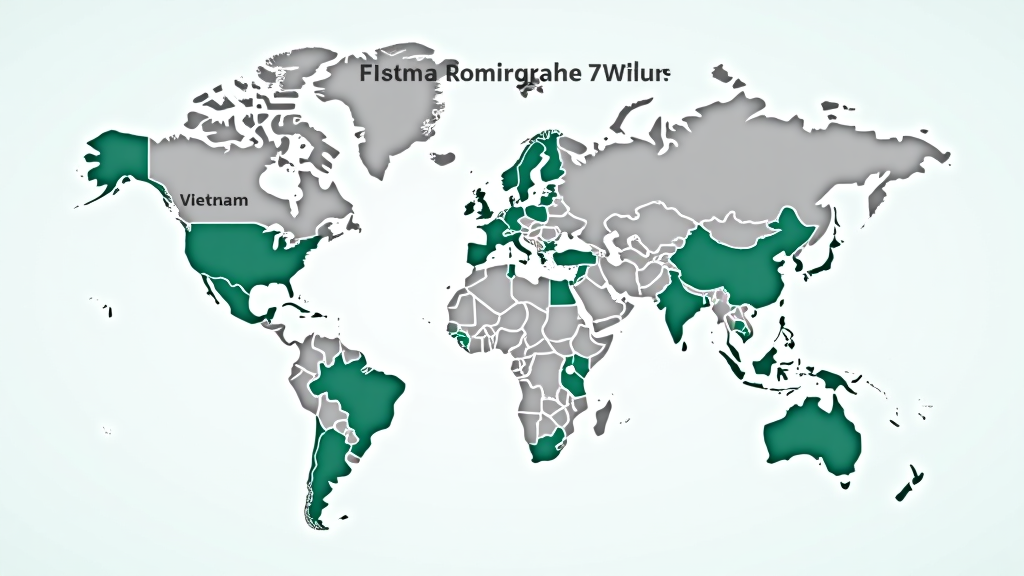

Current State of Global Crypto Adoption

According to recent studies, the global crypto adoption rate has skyrocketed over the last few years. Reports indicate that countries like

Comparative Analysis of Adoption Rates

Let’s take a closer look at the global adoption rates and comparisons:

| Country | Adoption Rate | User Growth Rate (2023-2024) |

|---|---|---|

| Vietnam | 46% | 30% |

| Nigeria | 35% | 25% |

| United States | 20% | 15% |

| Brazil | 18% | 10% |

As we observe, Vietnam shows extraordinary promise in terms of

Factors Influencing Adoption Rates in Emerging Markets

Several key factors contribute to the rapid adoption of cryptocurrencies in emerging markets:

ong>Regulatory Environment: ong> Supportive regulations, such as favorable tax laws and compliance frameworks, encourage crypto usage. As seen in Vietnam, where the government has initiated various blockchain projects.ong>Financial Inclusion: ong> Cryptocurrencies offer opportunities for the unbanked, allowing individuals in underbanked regions to access financial services easily.ong>Technology and Infrastructure: ong> Improving internet connectivity and smartphone penetration bolster crypto adoption, especially in developing areas.

Localized Trends: Vietnam’s Unique Crypto Landscape

Within Vietnam, user demographics indicate that millennials and Gen Z are the primary adopters of cryptocurrencies, driven by a combination of curiosity and financial aspirations. Recent surveys show:

- Over 60% of Vietnamese youth are interested in investing in cryptocurrencies.

- The most popular cryptocurrencies include Bitcoin, Ethereum, and newly emerging altcoins, reflecting a diverse investment interest.

As part of its strategy, the Vietnamese government also released educational programs focusing on blockchain technology, thus enhancing public understanding and acceptance.

The Impact of Global Events on Crypto Adoption

In countries grappling with economic instability, cryptocurrencies are often regarded as a safer alternative. A pertinent example would be Venezuela, where citizens are increasingly turning to Bitcoin amid hyperinflation, offering us valuable insights into the resilience of cryptocurrencies.

Real-World Application: Adoption in Financial Services

Financial institutions, the backbone of traditional finance, have begun integrating cryptocurrencies into their services. Adoption is not merely a grassroots movement; major banks and financial platforms are leveraging blockchain to streamline transactions and provide innovative services:

- **PayPal** and **Square** facilitating crypto transactions.

- **Visa** allowing transactions in Bitcoin for merchant payments, indicating a shift toward digital currencies in everyday commerce.

As such, the future is looking optimistic for both users and institutions alike.

Challenges to Crypto Adoption

While global adoption rates rise, challenges remain:

ong>Security Concerns: ong> Issues such as hacking and fraud can deter potential users.ong>Regulatory Roadblocks: ong> Conflicting regulations can create uncertainty in the market.ong>Market Volatility: ong> The fluctuating nature of cryptocurrency prices poses risks for investors.

Nevertheless, as security measures improve and regulatory environments become clearer, these challenges can be addressed effectively.

Predictions for 2025

Looking ahead, the

- A continued rise in institutional investments in cryptocurrencies.

- Increased acceptance of blockchain technology in various sectors, from logistics to healthcare.

- Educational initiatives that promote awareness about the benefits and risks associated with cryptocurrencies.

As countries like Vietnam continue to innovate and develop their crypto frameworks, they may serve as models for others looking to enhance their adoption rates.

In conclusion, understanding

As we embrace this new digital revolution, keep an eye on the trends—but also approach with caution and informed planning.

For further insights, visit our articles on Vietnam’s cryptocurrency tax regulations and the latest trends in decentralized finance.

Conclusion

The ongoing transformation brought about by cryptocurrency marks a pivotal moment in finance. As we look toward 2025 and beyond, one thing remains clear: staying informed and involved in this rapidly evolving landscape is crucial for businesses and individuals alike.

Author: Dr. Alice Nguyen

Dr. Alice Nguyen is a leading expert in blockchain technology and financial systems, with over 20 published papers on digital currencies. She has also led major audits for known blockchain projects, advocating for security and transparency across the financial landscape.