Introduction

In the ever-evolving world of cryptocurrency, understanding technical indicators can greatly enhance your trading strategies. With approximately

Understanding Technical Indicators

Technical indicators are mathematical calculations based on the price, volume, or open interest of a security, used to forecast future price movements. Traders often utilize these indicators to determine market sentiments, find trends, and make predictions about future price movements.

Here’s a simple analogy: consider technical indicators as compass tools for traders; they guide your decisions based on varying market conditions. While the compass itself might not navigate the way for you, it certainly points you in the right direction.

The Importance of Technical Indicators in Crypto Trading

ong>Market Sentiment: ong> They help gauge whether the market is bullish or bearish.ong>Decision Making: ong> Indicators assist in making informed buying or selling decisions.ong>Risk Management: ong> Traders can set stop-loss orders based on indicator signals to mitigate risks.

As the cryptocurrency market continues to expand, particularly in regions like Vietnam—where user growth rate has increased by

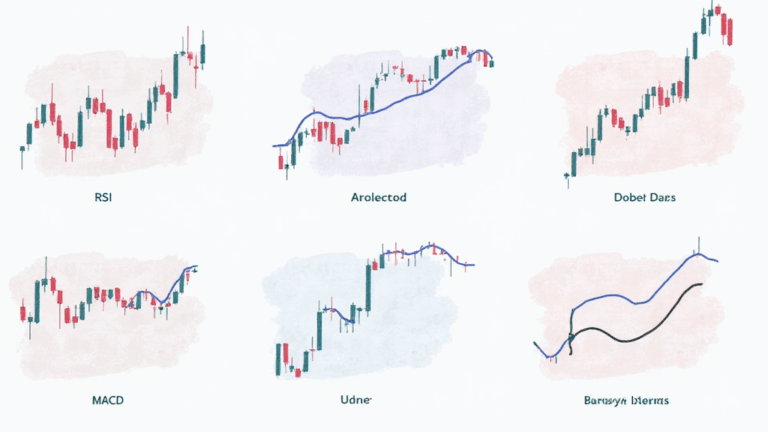

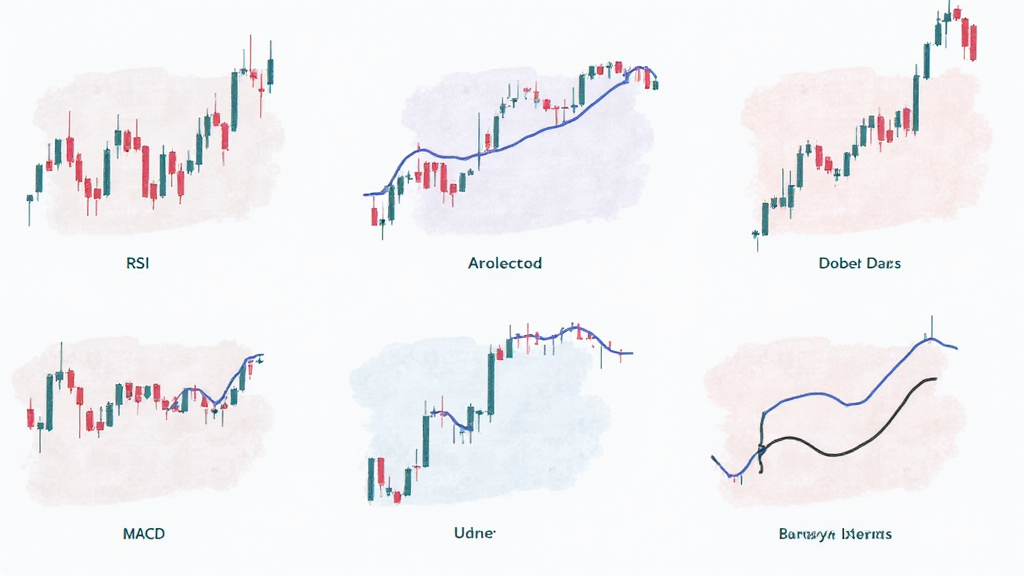

Common Technical Indicators Explained

Now that we understand what technical indicators are, let’s break down some of the most common ones used in crypto trading.

1. Moving Averages

Moving averages (MAs) are lagging indicators that smooth out price data by creating a constantly updated average price.

2. Relative Strength Index (RSI)

The RSI measures the speed and change of price movements. It ranges from 0 to 100, with values above 70 indicating that an asset may be overbought and values below 30 suggesting that the asset may be oversold. The RSI can be an invaluable tool for identifying potential reversal points.

3. Moving Average Convergence Divergence (MACD)

The MACD is a trend-following momentum indicator showing the relationship between two moving averages of a security’s price. The MACD is calculated by subtracting the

4. Bollinger Bands

Bollinger Bands consist of a middle band (SMA) and two outer bands (standard deviations away from the SMA). When the bands widen, it indicates increased volatility; when they contract, it suggests decreased volatility.

5. Volume

Volume refers to the number of shares or contracts traded in a security or market during a given period. High volume can signify strong market momentum—either up or down—giving traders clues about market strength.

Implementing Technical Indicators in Trading

To effectively utilize technical indicators in your trading strategies, consider the following:

ong>Combine Indicators: ong> No single technical indicator is perfect. Use multiple indicators to confirm signals.ong>Test Strategies: ong> Before applying strategies in live markets, backtest them to evaluate possible performance.ong>Stay Informed: ong> Keep up with industry news and changes to market dynamics.

As you practice with technical indicators, keep in mind the importance of emotional discipline and risk management.

Conclusion

Understanding and applying technical indicators can significantly elevate your crypto trading experience, especially as the landscape continues to change rapidly. Remember, while these tools can enhance your decision-making capabilities, they should be used thoughtfully and in conjunction with market analysis.

For more insights into crypto trading strategies, check out hibt.com. As the Vietnamese market continues to grow, implementing robust trading strategies has never been more important.

By learning how to utilize technical indicators effectively, you’re paving the way towards success in the dynamic crypto environment.

Written by