The Importance of a Trading Journal in Crypto: Best Practices and Tips

With over $1 trillion lost to poor trading decisions in recent years, maintaining a trading journal has become essential for cryptocurrency traders. A trading journal crypto allows you to track your trades, analyze your performance, and ultimately improve your strategies. In this comprehensive guide, we’ll explore why you need a trading journal, how to effectively maintain it, and share some tips tailored just for traders in the rapidly evolving crypto landscape.

Why is a Trading Journal Important?

Many traders overlook the power of a trading journal. Think of it as your trading roadmap—like a GPS for navigating the often turbulent waters of cryptocurrency trading. Here are a few reasons why keeping a journal is critical:

ong>Performance Analysis: ong> By recording your trades, you can spot patterns in your performance and make informed adjustments.ong>Emotional Control: ong> Documenting your thoughts and feelings during trades helps you manage emotional trading decisions.ong>Strategic Improvement: ong> Learn from your mistakes and successes, refining your trading strategies over time.

For example, a trader might discover that they consistently perform poorly after a particular news event. Keeping track helps them avoid similar situations in the future.

How to Create a Trading Journal for Cryptocurrencies

Creating a trading journal crypto is easier than you think. Here’s a step-by-step guide to get you started:

Step 1: Choose Your Platform

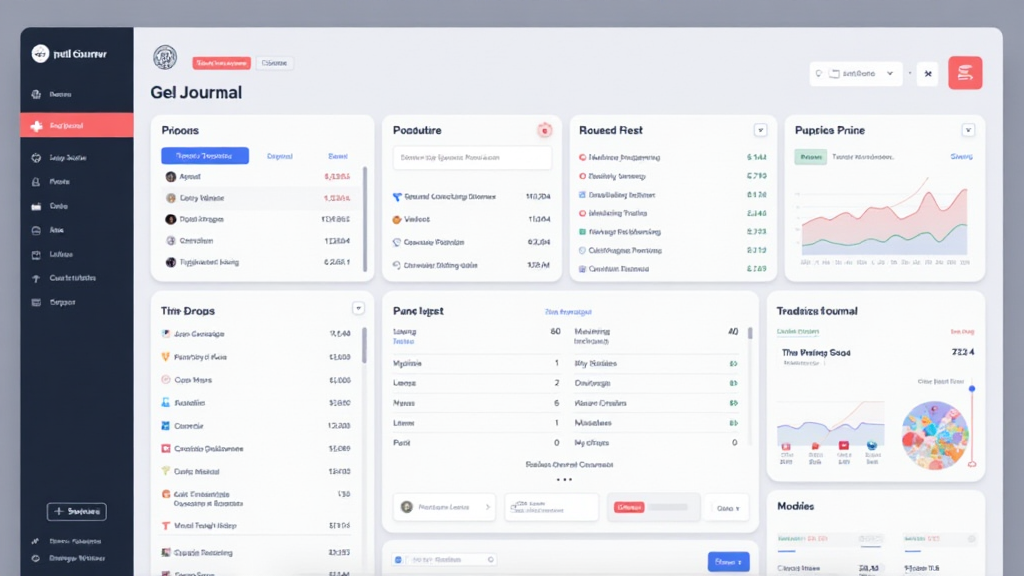

Decide whether you want to keep a physical journal or a digital one. Digital journals can offer greater flexibility and accessibility. Popular options include Spreadsheet software, specialized trading journals, or straightforward applications like Notion or Evernote.

Step 2: Define What to Record

Your journal should include the following:

ong>Date and Time: ong> When did you enter or exit trades?ong>Trade Details: ong> Crypto asset, entry and exit prices, size of trade.ong>Outcome: ong> Profit or loss and the percentage gained or lost.ong>Rationale: ong> Why did you make that trade? What was your analysis?ong>Emotions: ong> Document your feelings before and after each trade.

Step 3: Regularly Review Your Journal

Set aside time weekly to review your journal. Identify trends in your successes and losses. Here’s the catch: You might need to strip away your biases while analyzing entries. Ask questions like:

- Which strategies are working?

- What were the market conditions during successful trades?

- Did I go against my set plan? Why?

Doing this creates a feedback loop, leading to continuous improvement.

The Benefits of a Trading Journal in the Vietnamese Market

As Vietnam continues to see a significant surge in crypto users (with a staggering growth rate of 60% in 2023 alone), a trading journal becomes increasingly vital. Here are some localized benefits for Vietnamese traders:

ong>Identify Local Trends: ong> Tracking trades helps recognize specific trends influenced by regional factors.ong>Regulatory Awareness: ong> With fluctuating regulations (tiêu chuẩn an ninh blockchain), journaling can help you navigate legal landscapes efficiently.ong>Community Insights: ong> Joining local trading groups and sharing journals can provide valuable guidance.

Additional Tips for Maximizing Your Trading Journal

Here are ways to enhance your trading journal experience:

ong>Integrate Analytics Tools: ong> Use software that provides insights on your journal’s data, amplifying your performance tracking.ong>Fundamental and Technical Analysis: ong> Document market news and technical data to understand what impacts your trades.ong>Build Goals: ong> Set clear, measurable trading goals within your journal and track your progress meta-data.

Just as the Vietnamese coffee market has unique characteristics, so do your trading strategies. Tailor your journal entries to reflect your analysis methods and personal experiences.

Real-world Examples

Let’s look at a couple of hypothetical scenarios to illustrate the effectiveness of a trading journal:

ong>Scenario 1: ong> A trader notes frequent losses after trading volatile coins. They decide to document these trades and realize they are often trading on impulse. They adjust their approach by setting a criteria checklist before making a move.ong>Scenario 2: ong> A trader frequently notes patterns where altcoins surge post-major news. They develop a strategy to capitalize on these market movements consistently, improving their profits by 40%.

Final Thoughts

Creating and maintaining a trading journal is a simple yet powerful strategy for crypto traders. By regularly documenting and reviewing your trades, you can enhance your analytical skills, emotional control, and overall trading performance. No matter your experience level, a trading journal is a must-have tool in the fast-paced world of cryptocurrency trading.

To get started on your journey, check out hibt.com for more tips and resources. Be aware that our guidance is subjective—consult local regulations before making decisions.

Remember, your trading journal is an investment in yourself, giving you greater clarity and control over your trading decisions, especially as the crypto market continues to evolve.

As you embark on this journey, consider the insights from industry leaders like our fictional crypto expert, Dr. Alex Martin, who has authored over 30 papers on cryptocurrency trends and led critical audits on prominent blockchain projects.