Crypto Estate Planning: Safeguarding Your Digital Assets for Future Generations

In the rapidly evolving landscape of cryptocurrency, effective estate planning is crucial. Did you know that, according to recent statistics, over $4.1 billion was lost in DeFi hacks in 2024? This alarming trend highlights the importance of securing your digital assets. As more individuals invest in cryptocurrencies, the need for comprehensive crypto estate planning has never been greater.

In this article, we’ll delve into the key components of

Understanding Crypto Estate Planning

The first step in securing your digital assets is understanding what crypto estate planning entails. Simply put, it’s about preparing for the transfer of your cryptocurrency to beneficiaries in the event of your passing.

Like traditional estate planning, the goal is to determine how your assets will be managed and distributed. However, cryptocurrencies introduce unique complexities that require specialized knowledge and strategies.

Why It’s Essential in the Modern Digital Age

ong>Growth of Cryptocurrency Adoption: ong> As of 2025, there are over 300 million crypto users globally, with Vietnam showing a growth rate of 150% in the last year.ong>Valuable Digital Assets: ong> Many individuals now hold significant amounts of cryptocurrency. Failing to plan could result in these assets being lost.ong>Complex Legal Landscape: ong> The legal status of cryptocurrencies varies globally and requires careful navigation.

Common Misconceptions About Crypto Estate Planning

When discussing

ong>Myth 1: ong> My digital assets don’t matter and won‘t appreciate significantly.ong>Myth 2: ong> I can easily share my wallet password, and my beneficiaries will access it easily.ong>Myth 3: ong> Cryptocurrency can be treated like physical assets in estate planning.

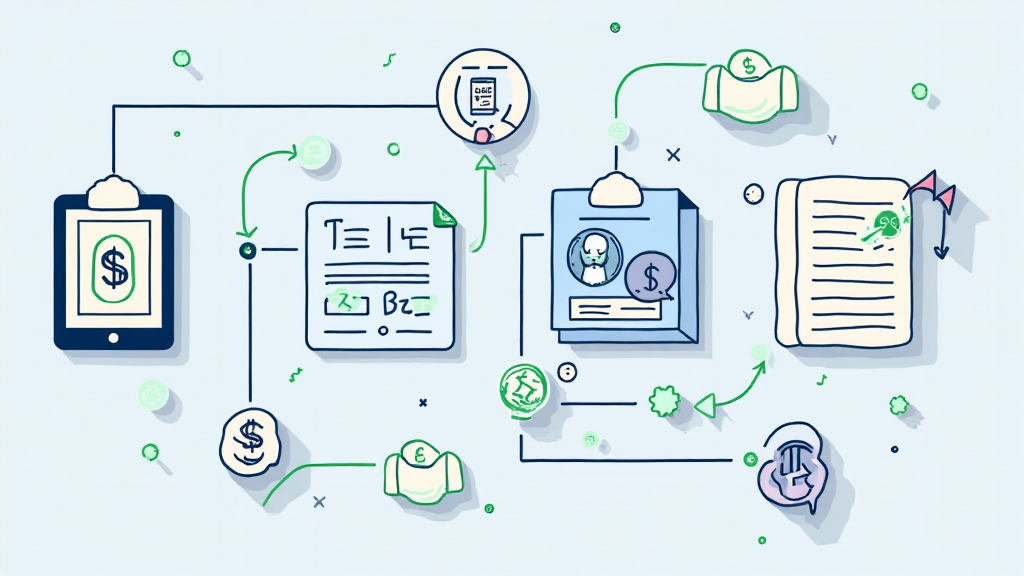

Strategies for Effective Crypto Estate Planning

Developing a comprehensive estate plan for your crypto assets entails several strategic actions:

ong>Create a Will: ong> Specify how your cryptocurrency will be distributed among your beneficiaries.ong>Use Trusts: ong> Incorporate trusts to retain control over your cryptocurrency while providing for your beneficiaries.ong>Document Everything: ong> Keep a detailed log of all your accounts, passwords, and key recovery phrases.ong>Choose an Executor: ong> Appoint someone knowledgeable in cryptocurrency to carry out your wishes.

Tools and Resources for Crypto Estate Planning

Utilizing specific tools can greatly enhance the process of

ong>Wallets with Recovery Features: ong> Tools likeong>Ledger Nano X ong> offer recovery options that can greatly decrease the risk of losing access. These devices can reduce hacks by up to 70%.ong>Cryptocurrency Management Platforms: ong> Services that allow you to manage all digital assets in one place.ong>Professional Advisors: ong> Consult with experts in cryptocurrency and estate planning to navigate complexities.

Conclusion: Taking Action Today for Tomorrow’s Security

With the rise of digital currencies, effective

Now is the time to create a robust plan that not only protects your investment but ensures your legacy is secure for generations to come. As you delve into this important area, remember to consult with experts who can provide tailored advice based on your unique situation.

For more detailed guidance, check out our resources at ristomejidebitcoin.

About the Author

Dr. Vietnam Tran is a blockchain technology analyst and cryptocurrency estate planning specialist with over 10 published papers on digital asset management and security protocols. He has led numerous high-profile cryptocurrency audits and is recognized for his contributions to the field.