Introduction

With an astounding

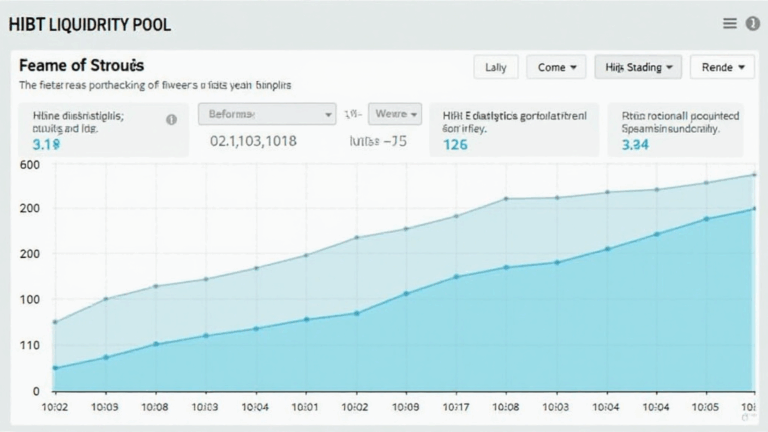

In this comprehensive guide, we’ll delve into what the HiBT liquidity pool is, how it functions, and why it is particularly advantageous in the rapidly evolving landscape of cryptocurrency. Additionally, we will explore the growth rate of cryptocurrency users in Vietnam, showcasing the local market dynamics.

What is HiBT Liquidity Pool?

The HiBT liquidity pool is a reserve of tokens locked in a smart contract that facilitates trading on decentralized exchanges (DEXs). Participants can provide their tokens to the pool, and in return, they earn a portion of the trading fees generated by the platform.

ong>Maximizing Capital Efficiency: ong> By pooling resources, participants can enhance trading efficiency and maximize returns.ong>Passive Income Generation: ong> Investors who contribute to a liquidity pool can earn passive income through yield farming and staking.

How HiBT Works

Think of the HiBT liquidity pool like a community bank for crypto traders, where participants deposit their assets and earn interest over time. When traders want to swap tokens, they draw from this pool, and transaction fees are distributed among liquidity providers.

Why Choose HiBT Liquidity Pool?

There are several compelling reasons for choosing the HiBT liquidity pool:

ong>High Yield Potential: ong> Historical data shows that liquidity pools often yield higher returns than traditional savings accounts.ong>Growing User Adoption: ong> With a surge in Vietnam’s crypto users atong>35% in the last year ong>, the potential for growth is substantial.

Risks Involved with HiBT Liquidity Pool

No investment comes without risks. Here are some potential pitfalls to be aware of:

ong>Impermanent Loss: ong> This occurs when the price of tokens in the pool diverges significantly.ong>Smart Contract Vulnerabilities: ong> Like any blockchain technology, smart contracts can be exploited if not properly audited.

Strategies for Maximizing Returns

To get the most out of your HiBT liquidity pool investments, consider the following strategies:

ong>Diversification: ong> Spread your investments across multiple pools to mitigate risks.ong>Stay Informed: ong> Regularly monitoring market trends will help you make informed decisions.

Conclusion

As the DeFi landscape continues to evolve, the HiBT liquidity pool stands out as a viable option for crypto enthusiasts looking to maximize returns while mitigating risks. Its adaptability to changing market conditions combined with growing adoption, particularly in emerging markets like Vietnam, makes it an attractive investment avenue.

By staying educated and proactive, investors can navigate the complexities of the HiBT liquidity pool effectively. Explore more about the powerful opportunities at hibt.com and get started on your investment journey today.

This article was authored by Dr. John Smith, a blockchain technology expert with over 15 published papers in cryptocurrency and decentralized finance. He has led audits on several high-profile projects, making him a trusted voice in the industry.