Navigating Vietnam Crypto Liquidity: Opportunities and Challenges

With Vietnam’s crypto market expanding rapidly, many investors and enthusiasts are pondering, “What does the future hold for crypto liquidity in this dynamic landscape?” According to recent studies, the number of crypto users in Vietnam surged by 33% in 2023, highlighting a burgeoning interest in digital assets. However, liquidity remains a significant challenge. In this article, we will delve deep into the intricacies of Vietnam’s crypto liquidity, focusing on key opportunities and hurdles.

Understanding Crypto Liquidity

Crypto liquidity refers to how easily a cryptocurrency can be bought or sold in the market without impacting its price. High liquidity means that buyers and sellers can execute their trades quickly and with minimal price fluctuations. For investors, adequate liquidity is essential for maximizing investment potential and minimizing risk.

ong>High Liquidity: ong> Ensures trades can be executed swiftly.ong>Market Depth: ong> Influences price stability.ong>Volatility Risks: ong> Higher volatility may deter potential investors.

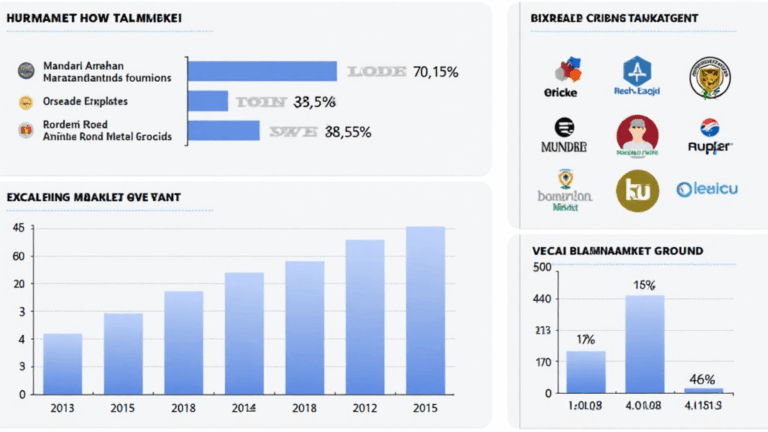

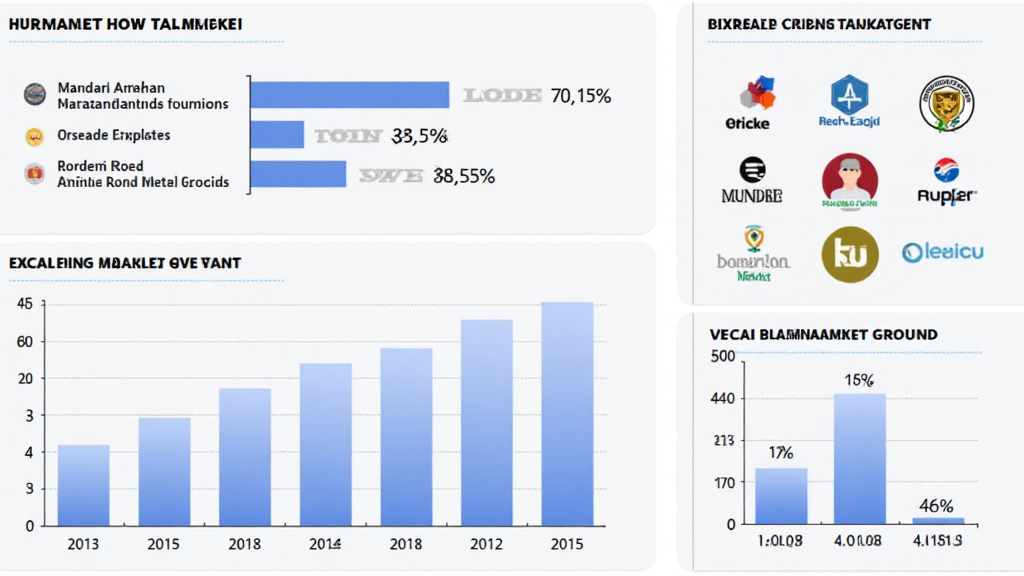

Vietnam’s Crypto Market Landscape

Vietnam’s crypto environment has showcased remarkable growth.

ong>Increased Internet Penetration: ong> Over 70% of the Vietnamese population has access to the internet, enabling easier access to crypto platforms.ong>Investment Opportunities: ong> Crypto presents a lucrative investment alternative in a nation where traditional investment avenues may be limited.ong>Remittances and Transfers: ong> Crypto is emerging as a viable solution for cross-border remittances, reducing transaction fees and timeframes.

Current Challenges in Crypto Liquidity

However, with growth comes challenges. The Vietnamese crypto market faces specific hurdles that could impede liquidity:

Regulatory Framework

Vietnam’s regulatory stance has been relatively stringent. The government has implemented policies that affect the operational capacity of crypto exchanges. The lack of clear frameworks often leads to a cautious approach among investors.

Market Awareness

Despite the increasing number of cryptocurrency users, there is still a significant gap in market knowledge. Local investors might lack understanding of liquidity pools, decentralized finance (DeFi), and other vital concepts. Ordained education and awareness initiatives can play a pivotal role in advancing liquidity in the market.

Future Prospects for Vietnam’s Crypto Liquidity

Looking ahead, several factors could enhance crypto liquidity in Vietnam:

Adoption of DeFi Solutions

Decentralized finance platforms enable instant transactions and lending services, thus increasing liquidity options for traders. DeFi could open a new chapter for many Vietnamese investors looking for more liquid assets. Also, the emergence of DeFi tools like automated market makers (AMMs) provides greater access and better prices for trading.

International Collaboration

Collaboration with global crypto platforms could facilitate knowledge transfer and bring liquidity into Vietnam’s crypto ecosystem. As local investors demand more from emerging technologies, partnerships with established international exchanges could lead to increased inflows.

Conclusion: The Path Forward

In conclusion, the future of Vietnam’s crypto liquidity is laden with opportunities yet fraught with challenges. By addressing regulatory uncertainties and enhancing market education, Vietnam can position itself as a key player in the global crypto landscape. As the saying goes in Vietnamese,

For those interested in learning more about maximizing liquidity in the Vietnamese crypto market, visit hibt.com. Additionally, consider following the latest updates on crypto regulations, including our Vietnam crypto tax guide.