Cryptocurrency Risk Management: Safeguarding Your Digital Assets in 2025

With

Understanding Cryptocurrency Risk Management

Cryptocurrency risk management refers to the frameworks and strategies that investors use to identify, assess, and mitigate potential losses in their digital asset portfolios. Just as traditional finance incorporates risk management practices, cryptocurrency also requires robust systems to protect assets against market volatility, fraud, technological failures, and regulatory changes.

In Vietnam, the

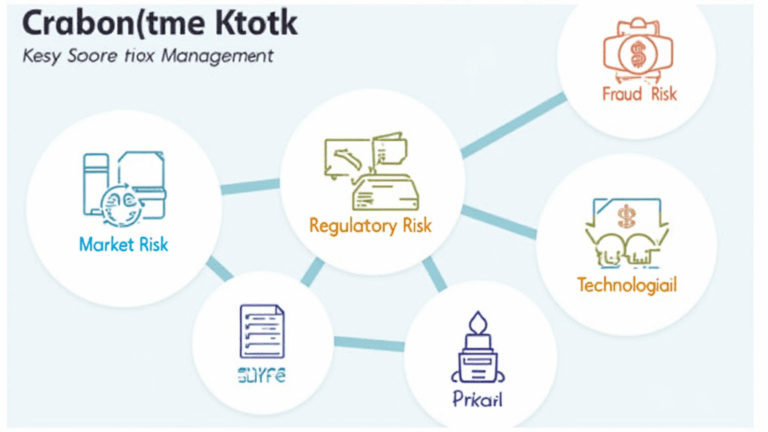

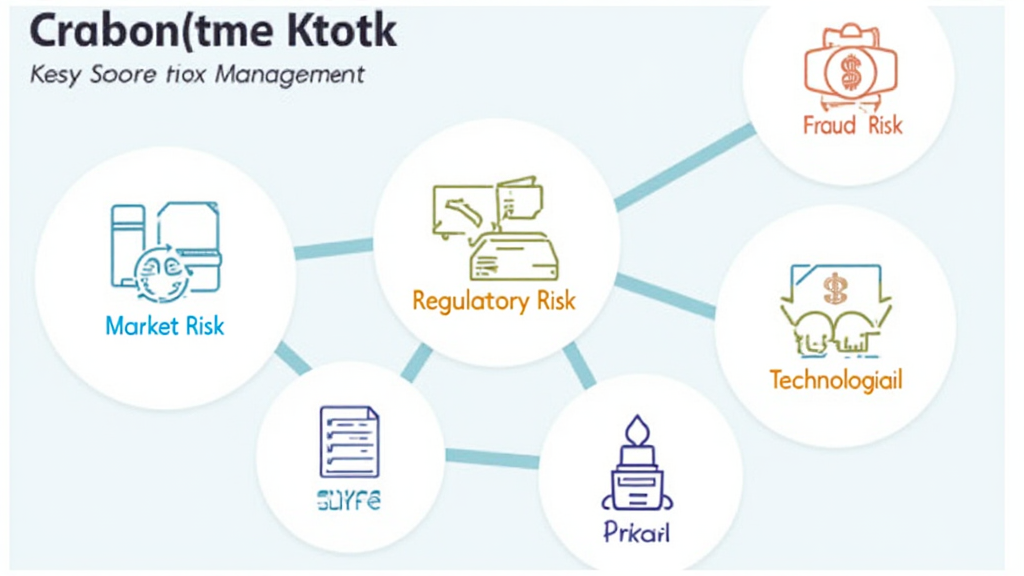

Types of Risks in Cryptocurrency

Various types of risks come into play in the world of cryptocurrencies. Here are the most prominent:

ong>Market Risk: ong> The risk associated with the volatility of cryptocurrency prices.ong>Liquidity Risk: ong> The difficulty of trading an asset without affecting its price.ong>Regulatory Risk: ong> Changes in laws that can impact how cryptocurrencies are used.ong>Technological Risk: ong> Issues related to software failures or cyberattacks on cryptocurrency platforms.ong>Fraud Risk: ong> The danger of scams and fraudulent schemes in the cryptocurrency space.

Market Risk

Market risk can lead to financial loss due to the fluctuations in crypto prices. To address this risk, diversification of assets is essential. By investing in multiple cryptocurrencies rather than concentrating on a single one, investors can reduce exposure to adverse price movements.

For instance, the Vietnamese market has seen potential in various altcoins, identified as the 2025 most promising altcoins to consider.

Liquidity Risk

Liquidity risk affects the ability to buy or sell cryptocurrency quickly without impacting its price significantly. To mitigate this, trades should occur in highly traded currencies or exchanges that offer high liquidity. Tools like

Regulatory Risk

The evolving regulatory landscape continues to pose risks in the cryptocurrency field. Each government has specific regulations regarding the legality and operational protocols of cryptocurrencies. In Vietnam, the government is progressively developing regulatory frameworks to protect investors while fostering the growth of the crypto ecosystem.

Investors should remain vigilant about regulatory announcements, as these could significantly impact market dynamics and investment strategies.

Technological Risk

Technological risks arise from security vulnerabilities in the software and platforms used for trading and holding cryptocurrencies. For instance, a smart contract failure can lead to the loss of funds. Regular audits, such as how to audit smart contracts, are crucial for ensuring the systems in place are secure.

Furthermore, utilizing hardware wallets like

Fraud Risk

The crypto space is rife with scams aimed at unwary investors. Phishing attacks, Ponzi schemes, and fake initial coin offerings (ICOs) are just a few examples. To protect themselves, investors should conduct thorough research and only interact with reputable exchanges and wallets.

As demonstrated by various reports, education is key to minimizing exposure to fraud in the crypto world.

Implementing Risk Management Strategies

Effective risk management requires a combination of strategies tailored to cryptocurrency investment. Here are some recommended practices:

ong>Conduct Comprehensive Research: ong> Before investing, gather as much information as possible about the selected asset.ong>Diversify Investments: ong> Spread investments across different cryptocurrencies and assets to minimize risks.ong>Utilize Secured Wallets: ong> Use hardware wallets for storing cryptocurrencies securely.ong>Regularly Audit Smart Contracts: ong> Ensure that any protocols or projects you engage with are secure and free from vulnerabilities.ong>Monitor Regulatory Changes: ong> Stay informed about changes in laws and regulations that may impact your investments.

The Role of Education in Risk Management

Continuous education about the cryptocurrency landscape is paramount for effective risk management. Attending webinars, joining online forums, and following credible news sources can help investors stay updated.

In Vietnam, the emergence of local educational initiatives about blockchain, titled

Conclusion: Staying Ahead in Cryptocurrency

In conclusion, cryptocurrency risk management is essential for anyone engaged in digital assets, especially in a quickly changing environment like Vietnam. By recognizing the various risks involved, employing effective strategies, and prioritizing education, investors can significantly enhance the protection of their assets.

As the crypto landscape evolves, remaining informed and proactive is an investor’s best defense in safeguarding digital assets.

For more insights on cryptocurrency and risk management strategies, consider exploring more about hibt.com and enhancing your knowledge on this topic. Additionally, keep an eye on economic and technological developments locally.

At

on” />