Understanding Yield Curve Inversion in Crypto

With recent fluctuations in the financial markets and an increasing number of discussions around economic indicators, the term

What is Yield Curve Inversion?

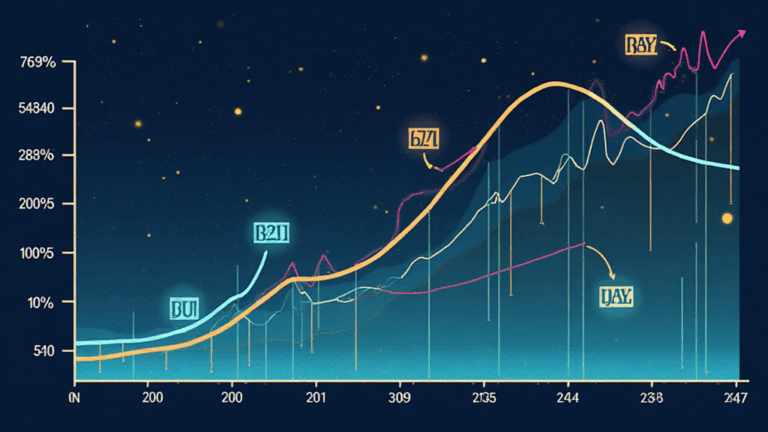

To grasp its implications in the crypto world, let’s break it down step by step. A yield curve typically illustrates the relationship between interest rates and the maturity dates of debt. An inversion occurs when long-term rates fall below short-term rates.

ong>Normal Yield Curve: ong> Typically slopes upwards, showing higher interest rates for longer maturities.ong>Inverted Yield Curve: ong> Slopes downwards, indicating that investors expect economic slowdown.

This phenomenon can create a ripple effect across all investment classes, from stocks to digital assets.

The Historical Context of Yield Curve Inversion

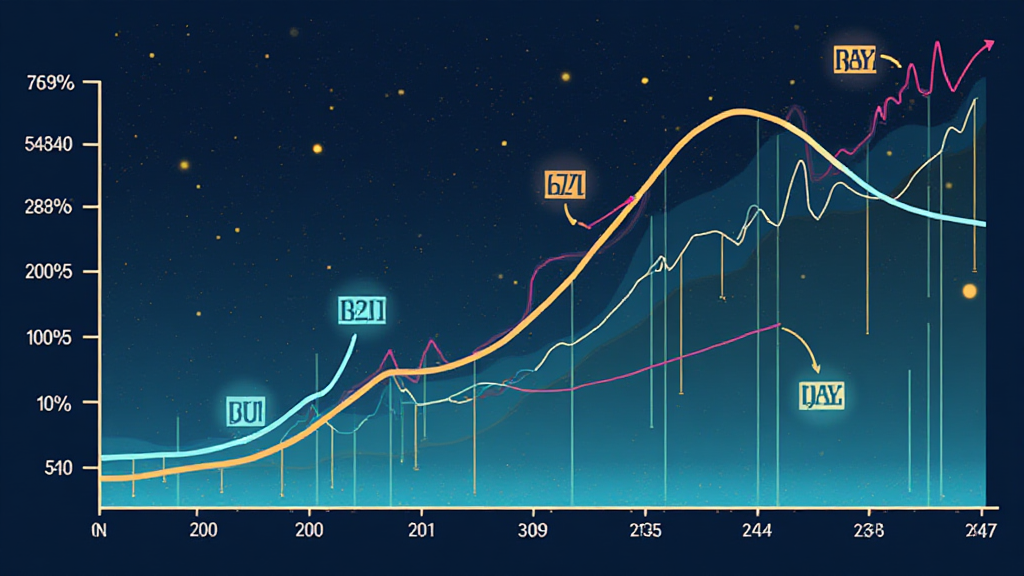

Historically, an inverted yield curve has been a precursor to economic recessions. For instance, the yield curve inverted shortly before the 2008 financial crisis. According to a 2025 survey by Chainalysis, 30% of crypto investors are changing their strategies in light of possible economic downturns. What does this mean for cryptocurrency?

Impact on Cryptocurrency Investments

The dynamics of yield curve inversion may lead investors to adjust their portfolio allocations.

ong>Flight to Stability: ong> Investors might move to more stable assets, steering clear of volatile cryptocurrencies.ong>Heightened Risk Aversion: ong> A rise in uncertainty may prompt investors to conduct more rigorous analyses of their crypto holdings.ong>Opportunities for Alternative Coins: ong> Projects with solid fundamentals may emerge as attractive options for risk-tolerant investors.

This shifting landscape raises questions: Are cryptocurrencies still a viable long-term risk asset, or do they face existential challenges during economic instability?

Why Crypto Investors Should Care?

Understanding the potential impacts of

ong>Market Segmentation: ong> Different cryptocurrencies may respond variably to an economic downturn, offering niches to explore.ong>Investment Strategies: ong> The ability to pivot investment strategies in response to macroeconomic indicators could prove advantageous.

Long-tail Strategies for Navigating the Market

As global economic indicators fluctuate, those engaged in crypto markets might consider the following:

- Evaluating potential assets, focusing on

ong>2025’s most promising altcoins ong> that could withstand economic pressures. - Conducting rigorous due diligence on projects, including how to audit smart contracts to mitigate risks effectively.

Strategies that incorporate comprehensive research can enhance investor confidence during uncertain times.

Conclusion

Invest wisely and remain engaged with the latest developments in the economic landscape and the crypto space.

In summary, navigating the complexities of yield curve inversions can provide investors with a roadmap to make informed decisions in turbulent times. Join the conversation about how ristomejidebitcoin can help you stay ahead of these trends.