Understanding Reversal Patterns in Crypto Trading

In recent years, the cryptocurrency market has witnessed unprecedented fluctuations. As of 2024, losses from DeFi hacks have exceeded $4.1 billion, prompting many traders and investors to seek better strategies for market predictions. One fundamental aspect of these strategies involves understanding reversal patterns in crypto, which can signal potential turning points in market trends. In this article, we’ll delve into various reversal patterns, their implications for trading, and how they fit into the larger crypto ecosystem.

What Are Reversal Patterns?

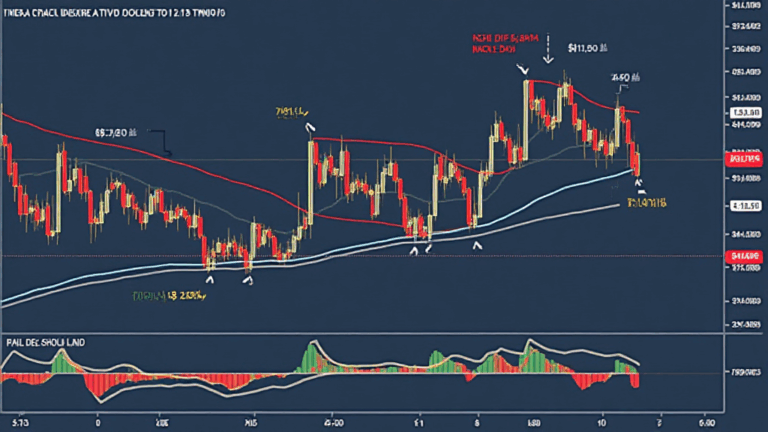

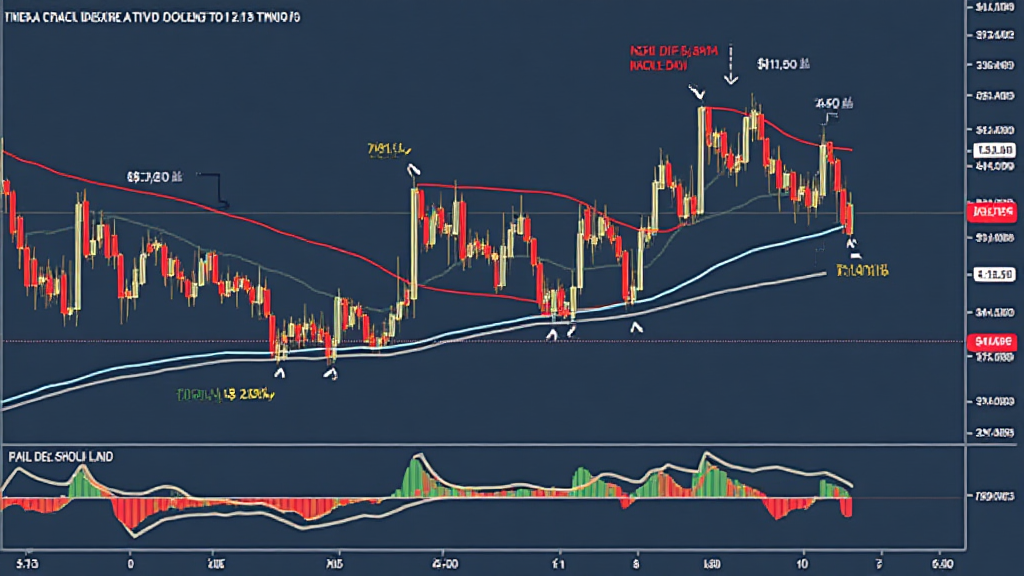

Reversal patterns are significant formations on price charts that indicate a reversal in price direction. These patterns provide insights into potential market sentiment shifts. For example, if a bullish trend begins to show signs of weakness, traders may spot a reversal pattern indicating a possible entry point for short sales. Conversely, a bearish trend may present opportunities for buying if a bullish reversal is detected. The key goal here is to interpret these signals accurately to make informed trading decisions.

Types of Reversal Patterns

ong>Head and Shoulders: ong> This pattern typically signals a transition from a bullish to a bearish trend. It consists of three peaks, with the central peak (head) being the highest.ong>Inverse Head and Shoulders: ong> Contrary to the traditional Head and Shoulders, this pattern indicates a bullish reversal. Traders look for it after a downtrend, consisting of three troughs.ong>Shooting Star: ong> This is a candlestick pattern that appears after an uptrend, signaling that the price might reverse downward.ong>Double Tops and Bottoms: ong> These patterns consist of two peaks (double top) or troughs (double bottom), which illustrate the market’s instability and potential reversals.

Interpreting Reversal Patterns

When analyzing reversal patterns, it’s vital to consider various levels of support and resistance. For instance, a double top might appear at a resistance level, indicating that buyers are unable to push prices higher. On the other hand, a double bottom can form at a support level, where selling pressure recedes, often leading to a price rebound. Assessing these patterns in conjunction with volume can enhance the reliability of signals; increased volume confirms the strength of the reversal.

Trade Strategies Using Reversal Patterns

In the crypto market, traders often employ different tactics to leverage reversal patterns effectively. Here are some strategies worth considering:

ong>Confirmation Wait: ong> Before acting on a reversal signal, traders often wait for additional confirmation, such as a breakout above a resistance level in a double bottom scenario.ong>Stop-Loss Orders: ong> Utilizing stop-loss orders can help manage risk. For instance, placing a stop-loss slightly below the neckline of a head and shoulders pattern can protect against unexpected volatility.ong>Combining Indicators: ong> Traders frequently use other indicators, such as RSI or MACD, alongside reversal patterns to validate their findings. Divergence between these indicators and price movements can strengthen the case for a reversal.

The Importance of Market Context

While reversal patterns can indicate potential market shifts, it’s essential to view them within the broader market context. Factors such as news events, technological developments in blockchain, or regulatory changes can significantly impact trading environments in Vietnam and globally. For instance, in 2023, Vietnam saw a growing interest in blockchain technology with a 60% increase in user traffic to exchanges, underscoring the importance of understanding market conditions during trading.

Cultural Context in Vietnam’s Crypto Market

As the crypto ecosystem evolves in Vietnam, debates around

Practical Examples of Reversal Patterns

Real-world examples of reversal patterns serve as a reference for traders:

ong>Bitcoin’s Double Top (2023): ong> Bitcoin formed a double top in March 2023, where it tested the $60,000 resistance twice before a sharp decline.ong>Ethereum’s Inverse Head and Shoulders (2024): ong> Ethereum’s chart depicted an inverse head and shoulders pattern, arising after a downtrend from $4,500 to $2,500, signaling a robust reversal in early 2024.

Limitations of Relying Solely on Reversal Patterns

Despite their potential, relying solely on reversal patterns can be misleading. A significant price drop doesn’t always mean a formation of a double bottom; external factors could also affect price movements. Traders should consider incorporating multiple tools and perspectives to validate their analysis.

Utilizing Advanced Tools and Technologies

For effective trading, consider leveraging tools such as:

ong>Charting Software: ong> Utilize charting software like TradingView to visualize and track reversal patterns effectively.ong>Alerts on Breaking News: ong> Setting up alerts on cryptocurrency news can help traders react promptly to triggers that may lead to reversals.ong>Mobile Trading Apps: ong> Many mobile apps facilitate on-the-go trading, enabling traders in Vietnam and elsewhere to seize possible opportunities instantly.

Conclusion: The Future of Trading with Reversal Patterns

Understanding reversal patterns is essential for navigating the volatile world of cryptocurrency trading. As traders become more adept at recognizing these patterns, they can better position themselves amidst the turbulence of the market. Therefore, whether you’re a seasoned trader or just beginning, leveraging reversal patterns can significantly enhance your trading strategies.

Remember, while reversal patterns provide valuable insights, they should be part of a broader strategy that considers market conditions, technological innovations, and personal risk tolerance. For a more secure trading experience and to enhance your knowledge further, visit ristomejidebitcoin for comprehensive resources.