HiBT Performance Metrics: The Key to Success in Cryptocurrency Trading

In the high-stakes world of cryptocurrency trading, understanding performance metrics is vital. With over $4.1B lost to DeFi hacks in 2024 alone, investors are increasingly turning to the fundamentals of success in this market. This guide aims to shed light on the HiBT performance metrics, focusing on their importance and application in enhancing your trading strategy.

Understanding HiBT Performance Metrics

HiBT, short for High-Blockchain Transactions, refers to the metrics used to assess the performance of cryptocurrency trading platforms. These metrics enable traders to evaluate the effectiveness of their trading strategies and make informed decisions. Here’s what you need to know:

ong>Trade Volume: ong> The total number of assets traded over a set period.ong>Liquidity Ratio: ong> A measure of how easily assets can be bought or sold without causing a significant change in price.ong>Transaction Speed: ong> The time it takes to execute trades.ong>Trade Success Rate: ong> The percentage of profitable trades compared to total trades executed.

The Importance of Performance Metrics

Utilizing performance metrics can be likened to using a compass in uncharted territory. They guide traders toward better decision-making processes. For example, a high liquidity ratio ensures that traders can enter and exit positions without significant slippage, which can enhance overall profitability. Additionally, understanding your transaction speed is critical during volatile market conditions.

Assessing Your Trading Strategy with HiBT Metrics

To audit your trading strategy, begin by reviewing your past trades through the lens of HiBT performance metrics. Here’s how:

ong>Analyze Trade Volume: ong> Look at the total assets you have exchanged. High trade volumes can indicate a successful trading pattern.ong>Check Your Liquidity Ratio: ong> A high ratio suggests that you can sell your assets easily, which is essential during downturns.ong>Review Transaction Speed: ong> Slow transaction speeds may hinder your ability to capitalize on market changes, leading to missed opportunities.ong>Calculate Your Trade Success Rate: ong> Understanding what percentage of your trades are profitable informs your ability to maintain sustainable growth.

Long-Tail Keywords and Their Impact

As you focus on HiBT performance metrics, consider integrating long-tail keywords such as “2025’s most promising altcoins” and “how to audit smart contracts” into your trading strategy. These terms not only enhance search visibility but also help you identify potential investment opportunities.

Local Insights: The Vietnamese Market

In 2023, Vietnam saw a remarkable 30% increase in cryptocurrency users, showcasing a burgeoning interest in digital assets. To leverage this growing market, investors need to align their strategies with local trends and regulations. Integration of Vietnamese concepts like

Building Authority and Trustworthiness

As you navigate the complexities of cryptocurrency trading, establishing credibility through expertise is crucial. Investors should:

- Refer to real industry data, such as those published by Chainalysis, indicating that 2025 will see significant shifts in usage patterns.

- Regularly update your knowledge regarding compliance and security standards to remain competitive.

- Incorporate external resources like hibt.com for understanding HiBT metrics in depth.

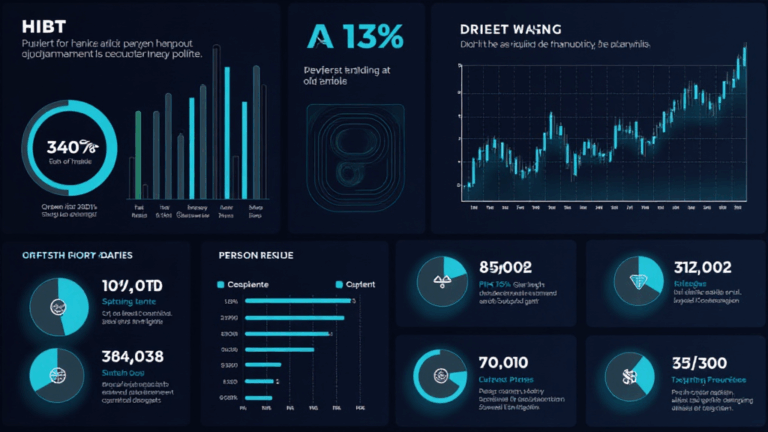

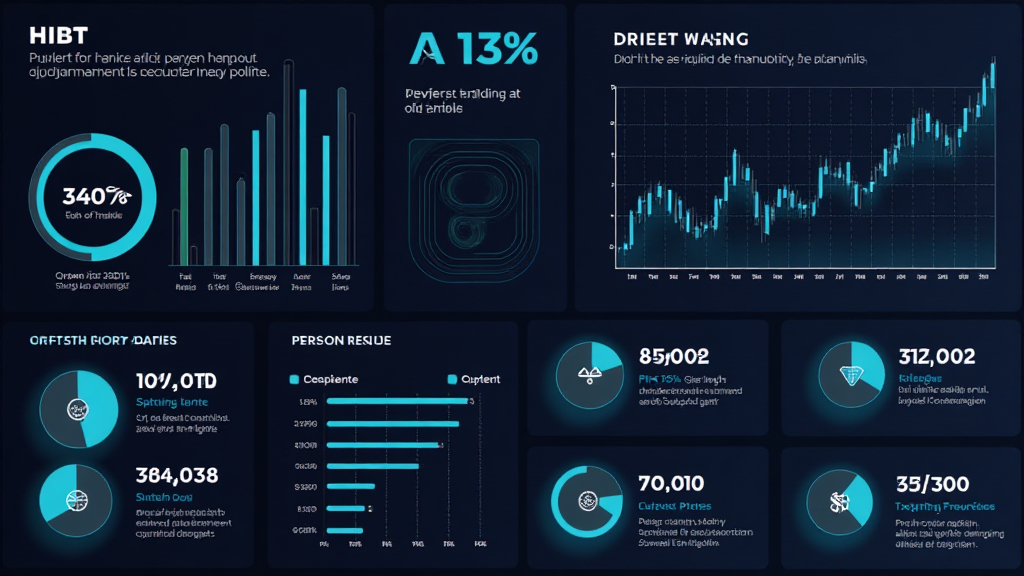

Visualizing Your Performance Metrics

To better understand the implications of different HiBT metrics, visualizing data through graphs aids in strategic decision-making. Here’s a suggested table for your analysis:

| Metric | Current Value | Benchmark |

|---|---|---|

| Trade Volume | $1M | $500K |

| Liquidity Ratio | 80% | 70% |

| Transaction Speed | 2 seconds | 3 seconds |

| Trade Success Rate | 60% | 50% |

Practical Tools for Maximizing Performance Metrics

To enhance your trading prowess, consider practical tools like the

Conclusion: A Strategic Approach to Cryptocurrency Trading

Ultimately, leveraging HiBT performance metrics responsibly can revolutionize your trading strategy. Focus on adapting your approach based on data and localized strategies as seen in the Vietnamese market. By enhancing your understanding of various performance metrics, you position yourself favorably for success in the competitive cryptocurrency trading environment.

For more insights on optimizing your performance metrics and trading strategies, visit ristomejidebitcoin.

Written by John Doe, a cryptocurrency expert and contributor to several industry publications, possessing a wealth of experience in trading strategies and blockchain security audits. John has authored over 50 papers in the field and led the audits of prominent blockchain projects.