CBDC Initiatives in Southeast Asia: A Transformative Approach

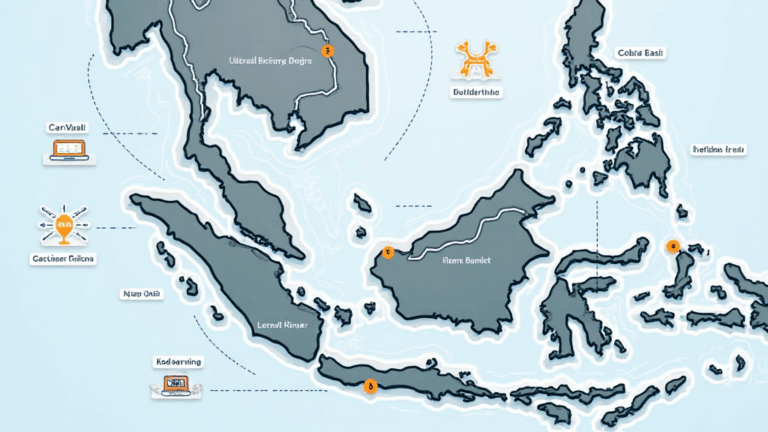

As of 2024, Southeast Asia is witnessing a tectonic shift in the digital economy landscape driven by the rise of Central Bank Digital Currencies (CBDCs). With over $4.1B lost to DeFi hacks globally, financial institutions are actively exploring CBDC initiatives to enhance security and streamline transactions. Let’s dive into the evolving world of CBDCs in Southeast Asia and understand their implications for businesses and consumers alike.

Understanding CBDCs: What They Are and Their Importance

CBDCs are digital currencies issued by central banks and are a response to the growing popularity of cryptocurrencies. They aim to provide a secure, efficient, and stable means of transaction in a digital economy. As the region‘s digital infrastructure improves, central banks across Southeast Asia, including Vietnam, Thailand, and Singapore, are showing increasing interest in developing their CBDCs.

ong>Enhanced Security: ong> CBDCs can potentially reduce fraud and cyber theft, similar to how traditional banking systems safeguard currency.ong>Financial Inclusion: ong> With a significant portion of the Southeast Asian population unbanked, CBDCs offer a pathway to financial services for millions.ong>Efficiency in Transactions: ong> CBDCs can reduce transaction costs and time, making financial systems more efficient.

The Role of Vietnam in CBDC Development

Vietnam is a substantial player in Southeast Asia’s CBDC initiatives. According to research from Hibt, the country’s smartphone penetration rate reached 72% in 2023, providing an accessible platform for digital currency adoption.

- Expanding User Base: With a user growth rate of 15% annually in digital finance, Vietnam is paving the way for CBDC adoption.

- Government Initiatives: The State Bank of Vietnam has begun pilot projects to test the feasibility of a CBDC.

Current CBDC Initiatives Across Southeast Asia

Southeast Asian countries are at various stages of CBDC exploration and implementation:

- Thailand: The Bank of Thailand has initiated the CBDC development phase and plans to explore its implementation for retail transactions by 2025.

- Singapore: The Monetary Authority of Singapore has been actively experimenting with digital cash systems and has successfully completed trials of a digital SGD.

- Indonesia: The central bank is investigating the potential of a digital rupiah while prioritizing compliance with local regulatory standards.

Challenges and Barriers to CBDC Implementation

Despite the promising outlook for CBDCs, several challenges must be addressed:

- Regulatory Concerns: Different regulations across countries may hinder cross-border CBDC transactions.

- Public Acceptance: Educating the masses about CBDCs will be crucial for successful adoption.

- Technological Infrastructure: Improving connectivity and speed of digital transactions is vital, especially in rural areas.

Strategic Partnerships and Collaborations

To optimize CBDC initiatives, collaboration across various sectors is essential:

- Fintech Partnerships: Governments should collaborate with fintech startups to design user-friendly platforms.

- International Cooperation: Regional stakeholders can work together to establish frameworks for cross-border transactions.

The Future of CBDCs in Southeast Asia

As we approach 2025, the future of CBDCs in Southeast Asia looks promising. Governments are grasping the potential of CBDCs to stimulate economic growth, improve payment efficiency, and enhance security measures. According to Chainalysis, the adoption of CBDCs could lead to a 30% reduction in transaction costs within the region.

Here’s the catch—while there are immense opportunities, success will ultimately depend on how well these initiatives can engage the public and adapt to dynamic financial landscapes.

Conclusion

CBDC initiatives across Southeast Asia are set to revolutionize the regional financial ecosystems. The interplay between traditional financial systems and digital currencies could mark a turning point in the way people transact, save, and invest. As we delve deeper into this exciting evolution, stakeholders must ensure proper frameworks are in place to mitigate risks and maximize the benefits. The discussion around CBDCs goes beyond just technology—it encapsulates the future of financial freedom across Southeast Asia.

For businesses and individuals aiming to stay ahead in this rapidly changing landscape, staying informed about CBDC developments through platforms like ristomejidebitcoin is essential.